As the winds of change blow through the stock market, savvy investors are reassessing their strategies to build portfolios that weather volatility and yield handsome returns. In this dynamic landscape, a one-size-fits-all approach is as outdated as a rotary phone. Here are key tactics to consider when crafting a profitable stock portfolio in 2024:

Diversification: The Golden Mantra:

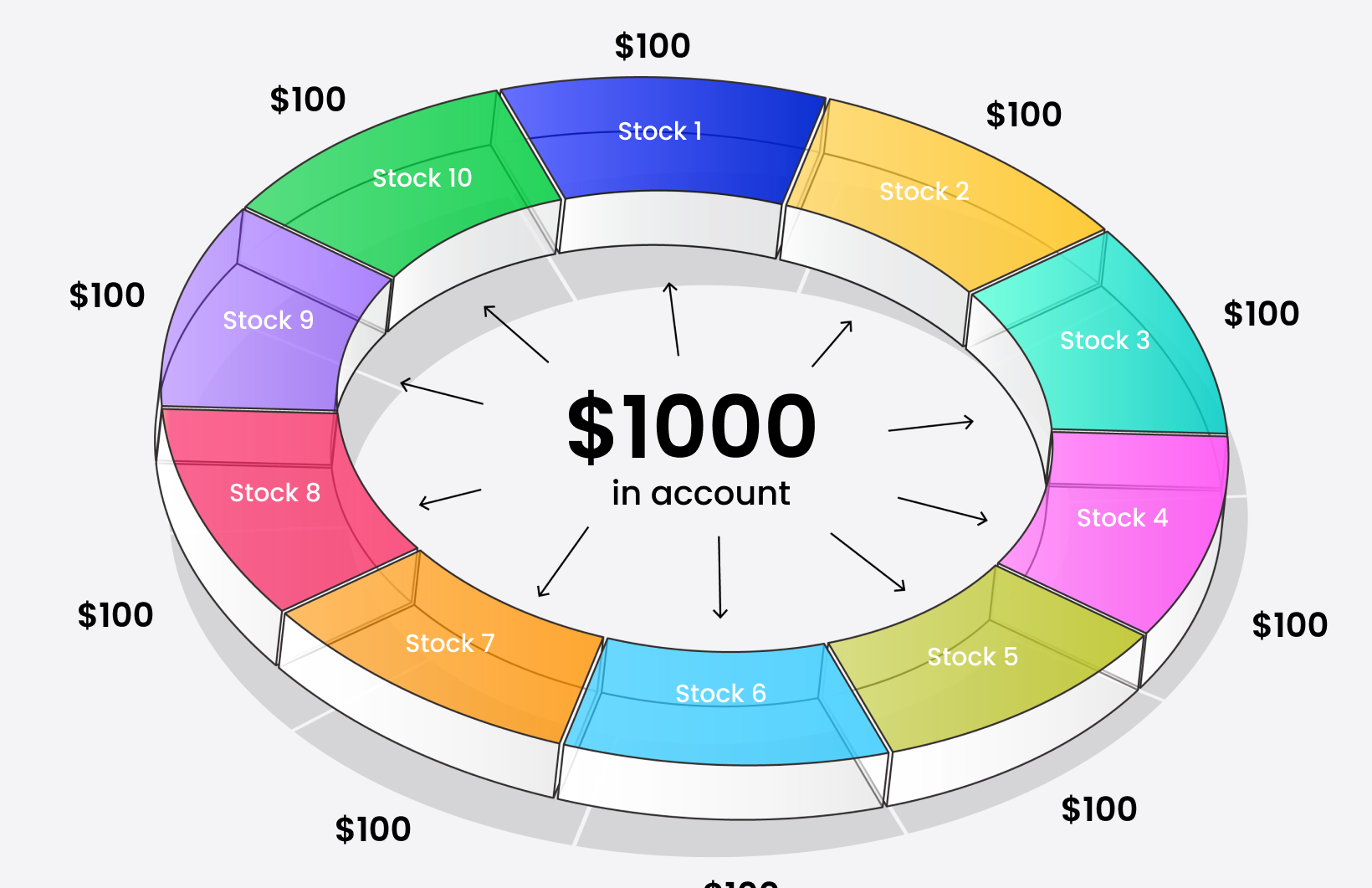

Never put all your eggs in one basket, especially in today’s market. Spread your holdings across various asset classes and sectors. Consider a mix of large-cap blue chips for stability, mid-cap growth companies for potential high returns, and even a touch of emerging markets for diversification. Remember, diversification isn’t just about spreading across industries, but also across geographies and investment types.

Value Hunting: Seeking Diamonds in the Rough:

While the allure of high-flying tech stocks may be tempting, don’t neglect the value potential hidden in under-the-radar companies. Look for businesses with strong financials, solid track records, and undervalued share prices. These diamonds in the rough often offer substantial upside when the market corrects.

Growth with Grit: Identifying Future Champions:

Balancing stability with growth is crucial. While it’s wise to have value anchors, injecting your portfolio with carefully chosen growth stocks can fuel impressive returns in the long run. Focus on companies with innovative technologies, disruptive business models, and strong leadership teams poised to capitalize on emerging trends.

The Green Wave: Riding the Sustainability Surge:

Sustainability is no longer a niche play, but a mainstream megatrend. Companies addressing climate change, promoting renewable energy, and implementing responsible ESG (Environmental, Social, and Governance) practices are attracting increasing investor interest. Look for leaders in the green revolution, not just for ethical reasons, but also for their potential to outperform in the long run.

Active Management vs. Robo-Advisors:

The old debate rages on. Do you actively manage your portfolio, meticulously choosing stocks and timing the market? Or do you trust the algorithms of robo-advisors to build and manage a diversified portfolio for you? The answer depends on your risk tolerance and time commitment. Active management, though potentially rewarding, demands constant research and market savvy. Robo-advisors offer convenience and automation, but may lack the flexibility of personalized selection.

Beyond Stocks: Exploring Diverse Horizons:

Remember, stocks aren’t the only path to profit. Consider diversifying with bonds for income stability, real estate investment trusts (REITs) for regular dividends, and even alternative assets like commodities or gold to hedge against inflation or market downturns.

Stay Informed, Adapt, and Evolve:

The market is a dynamic beast. Constantly educate yourself, stay abreast of economic news and geopolitical developments, and be ready to adapt your strategy as needed. Don’t be afraid to rebalance your portfolio, cut your losses, and seize new opportunities.

Building a profitable stock portfolio in 2024 requires a personalized approach, calculated risk-taking, and a keen eye for value and growth potential. By diversifying wisely, seeking hidden gems, embracing sustainable trends, and continuously learning and adapting, you can navigate the market’s labyrinthine paths and build a portfolio that weathers storms and yields rich rewards.